The Goods and Services Tax or GST is a 10 tax that is placed on many items and products across Australia. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy.

Non Deductible Tax Code Bl Sap Blogs

Import of goods with GST incurred.

. Imports under special scheme with no GST incurred eg. Jabatan Kastam Diraja Malaysia Appendix 2 - Guide to. Treatment of input tax attributable to exempt financial supplies as being attributable to taxable supplies.

Malaysia GST Reduced to Zero. The tax itself applies to essentially every product and service in Australia. What Is GST.

The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6. Input Tax 6 Import of Capital Goods. Malaysia GST Reduced to Zero.

Approved Trader Scheme ATMS Scheme. So should I create a new tax type GST for this purpose. Refers to all goods imported into Malaysia which are subject to GST that is directly attributable to the making of taxable supplies.

GST is calculated on CIF Cost Insurance and Freight Customs Duty payable. Monthly Tax Deduction MTD 6. Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018.

The fixed rate is 6 and some types of goods and services can be exempt from this tax while others are taxed at different rates. Overview of Goods and Services Tax GST in Malaysia. GST on purchases directly attributable to taxable supplies.

Income Tax Payment excluding instalment scheme 7. Adjustment to Input Tax. This guide includes everything you need to know about digital tax laws in Malaysia whether your customers live in Kuala Lumpur or Putrajaya.

For more information regarding the change and guide please refer to. Claim for input tax. Sales Tax and Service Tax were implemented in Malaysia on 1 September 2018 replacing Goods and Services Tax GST.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Real Property Gain Tax Payment RPGT 5. In order to understand the GST codes you must first understand what GST is.

GST is a multi-stage tax on domestic consumption. Non-applicability to certain business. Segala maklumat sedia ada adalah untuk rujukan sahaja.

Any business with a yearly turnover in excess of MYR 500000 is required to register for VAT in this country. Thats what this guide is for. Export of goods from Malaysia to Designated Areas.

Meaning of longer period. GST code Rate Description. 36 rows Tax Code Description GST Code Rate.

VAT in Malaysia known as Sales and Service Tax SST was introduced on September 1 2018 in order to replace GST Goods and Services Tax. 10 rows A GST registered supplier can zero-rate ie. It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1 June 2018.

For more information regarding the change and guide please refer to. No matter where you live or where your online business is based if you have customers in Malaysia you gotta follow Malaysian GST rules. Attribution of input tax to taxable supplies.

GST has been set at zero from 1 June 2018 to be replaced by a Sales Tax on 1 September 2018. 9 rows GST code Rate Description. GST code Rate Description.

GST is charged on all taxable supplies of. In Malaysia she sales tax charged at 10 is the default sales tax rate. Charging GST at 0 the supply of goods and.

Disallowance of input tax. In the Malaysia government website the GST tax type proposed is GST. The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6.

GST was only introduced in April 2015. Zero-rated The main difference between zero-rated and exempted goods is that the zero-rated are taxable supplies taxed at the SST 0 rate whereas exempted goods are non-taxable and not subject to SST. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018.

Purchases with GST incurred at 6 and directly attributable to taxable supplies. It was first put in place in order to replace a number of indirect. However I notice SAP use only A for output tax and V for input tax.

Secondly I notice the GST tax code listing have 2 3 or 4 characters however SAP standard provided 2 characters tax code only. There are 23 tax codes in GST Malaysia and categories as below.

Implementation Of Goods And Service Tax Gst In Malaysia Yyc Goods And Services Goods And Service Tax Malaysia

Why I Can Not See Gst On Capital Purchase In The Tax List

Import Goods That Have Gst Finance Dynamics 365 Microsoft Docs

Gst Tax Procedure Migration Taxinj To Taxinn For Procurement Process

How To Manually Adjust The Gst Amount When Creating A New Spend Money Or Bill

How A Perfect Gst Tax Invoice Should Look Like Eztax In Gst Help Invoicing Financial Accounting Tax

Malaysia Sst Sales And Service Tax A Complete Guide

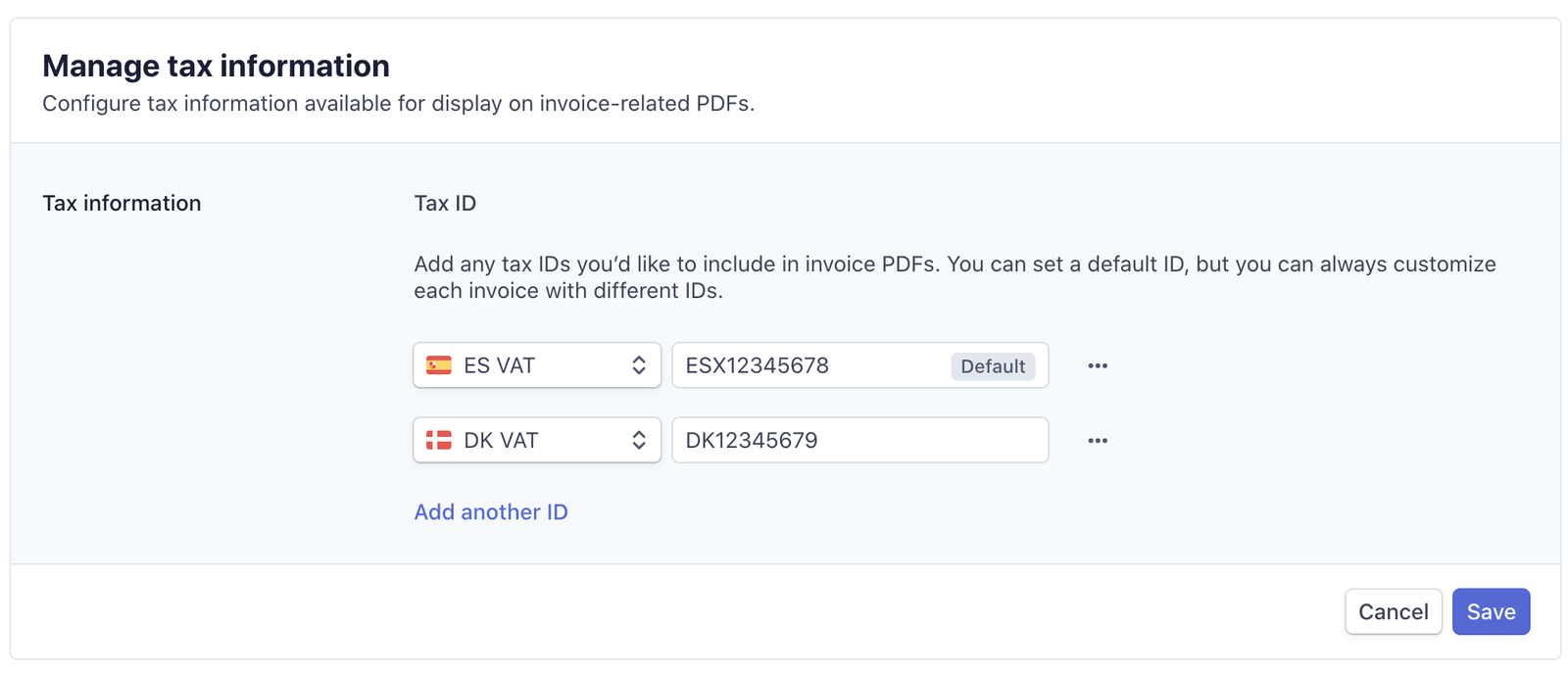

Account And Customer Tax Ids Stripe Documentation

Quickbooks File Tax Return Solarsys

Gst Rates In Malaysia Explained Wise

Degree Certificate That Cost Almost Rm50 000 From Sheffield Truly Proud Of It As I Use It To Degree Certificate Fake High School Diploma University Diploma

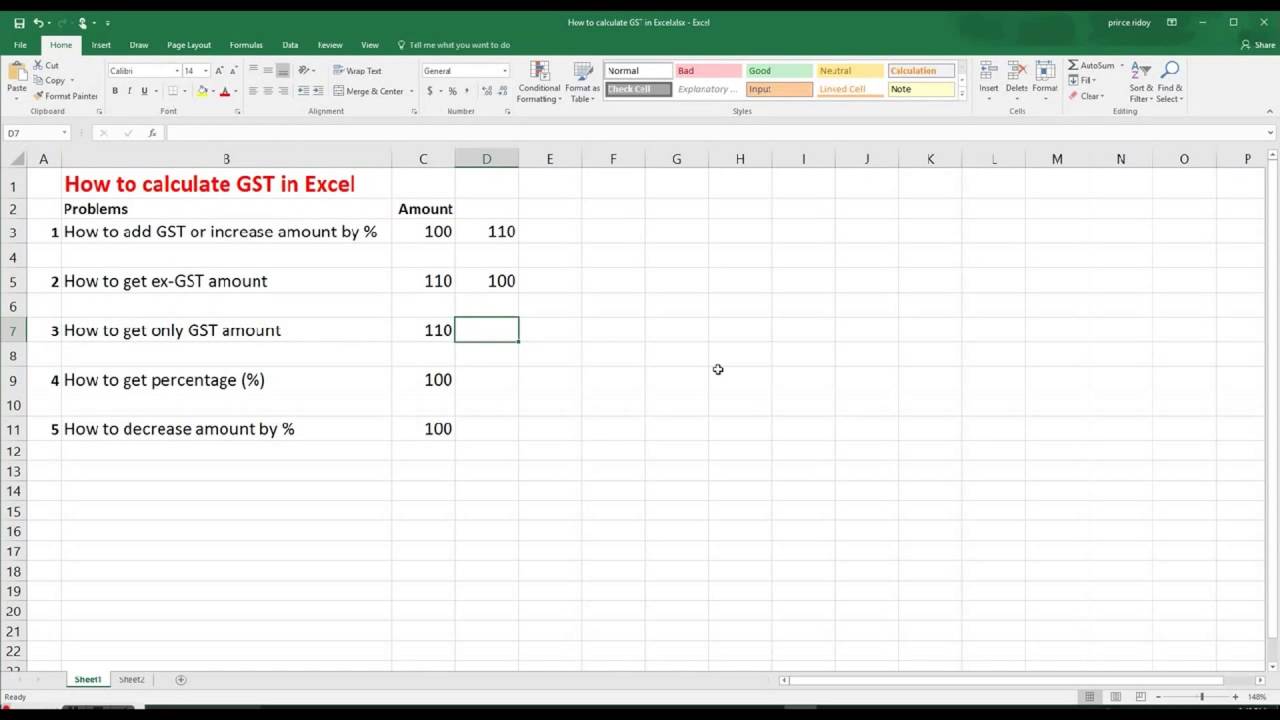

How To Calculate Gst In Excel By Using Different Techniques With Easy Step By Step Tutorial Youtube

Gst Portal Provides Simple To Use Offline Utility For Uploading Invoice Data And Other Records For Creating Gstr 1 Accounting And Finance Worksheets Offline

Tax Code Table Proline Documentation

Tds Due Dates List Dec 2019 Bio Data Accounting Software Due Date

Excel Tutorial Formulas For Calculating Gst At 15 Youtube

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll